How Does Debt Counselling Work?

Debt counselling is a legal and regulated process introduced by the National Credit Act (NCA) to help over-indebted South Africans regain control of their finances. The goal is to restructure your debt into an affordable repayment plan, one that protects your income, your assets, and relieves financial pressure.

At Debt Rescue, we guide you every step of the way with a personalised Debt Rescue Plan that’s tailored to your unique financial circumstances.

Why Debt Counselling was Created?

In 2007, the National Credit Act (NCA) introduced debt counselling / debt review as a legal process to protect over-indebted consumers. South Africa was facing a debt crisis, with reckless lending and unaffordable credit, pushing millions of consumers into severe financial distress. South Africans were losing their homes and vehicles, often without fully understanding their rights. Debt Counselling was introduced as a structured, legal and protective measure to prevent this from happening.

It still remains one of the most effective ways to help over-indebted South Africans manage their debt, avoid legal action and repossession and give them the ability to work toward financial rehabilitation.

Why Debt Counselling Works

Debt counselling isn’t just a form of debt relief — it’s a long-term solution that helps individuals rebuild their financial future. Here are the key benefits:

1. Your monthly debt repayments are reduced to fit what you can afford:

We negotiate with your creditors to reduce your instalments and extend your repayment terms.

2. You Only Pay One Fixed Monthly Amount

Instead of making multiple payments, you will only make one reduced payment each month to a registered Payment Distribution Agency.

3. You Receive Full Legal Protection from Creditors

Once you are placed under debt counselling, your creditors are not allowed to take any legal action or repossess your assets, for the debts included in your debt repayment plan.

4. Your are Not Blacklisted

When you are placed under debt review your credit record will reflect this, but this is seen as a pro-active and responsible step. Once you have fully paid off your debt, you will receive a clearance certificate, and the debt review flag will be removed from your credit profile.

5. Ongoing support from the first consultation until your final payment.

We are here to help you budget, provide emotional support, help you to rebuild your future and most importantly to avoid falling back into debt.

Enjoy a happier, stress-free you. Become debt free with Debt Rescue!

How Debt Counselling Works: An Example

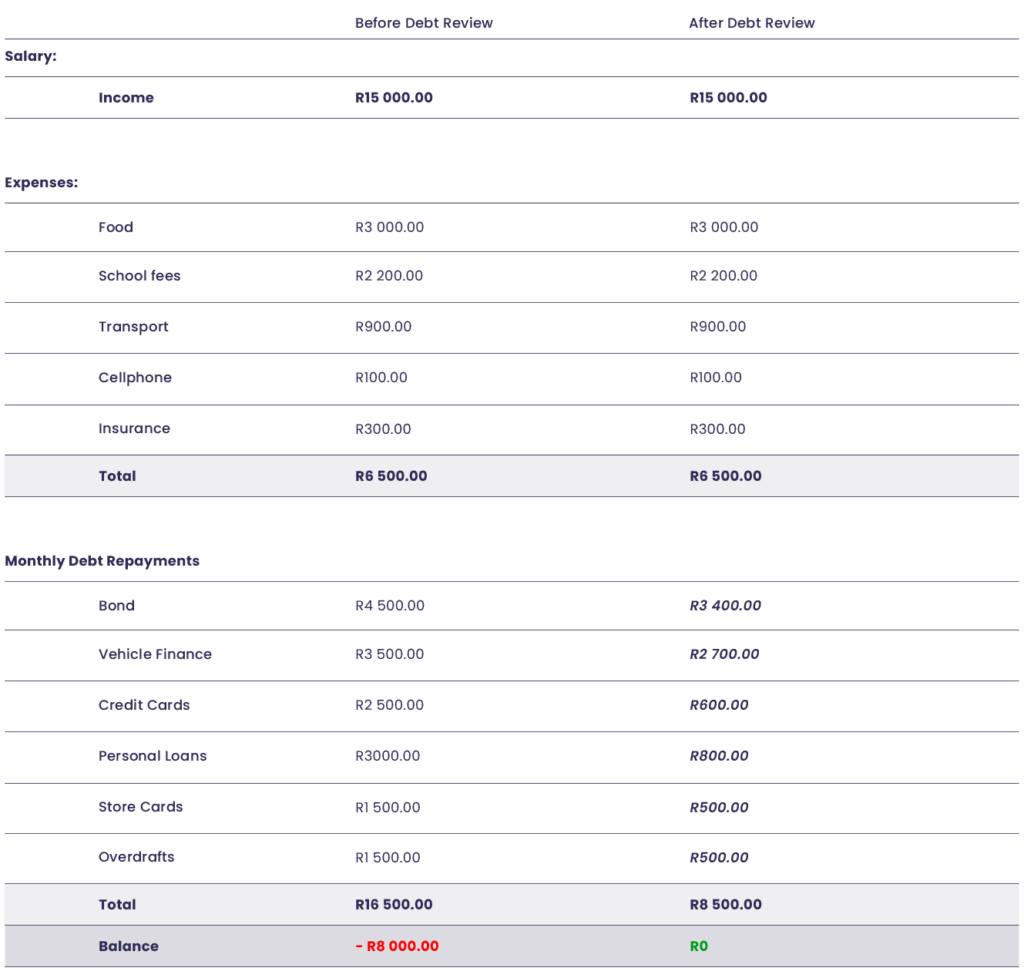

Take a look at how Debt Counselling actually works for your budget. Debt Counselling ensures that your monthly debt repayment amount is affordable, leaving you with enough to cover your essential living expenses:

The Debt Rescue Plan: Step-by-Step

Our process is simple, legally supported, and proven to work. Here’s how it unfolds:

Step 1: You Start With a Free No-Obligation Debt Assessment

We evaluate your income, expenses, and debts to determine if you’re over-indebted. You will need to supply us with:

Application checklist:

- ID Document

- Proof of Income

- Proof of Residence

- List of living expenses

Step 2: We Create Your Debt Rescue Plan

If you qualify, one of our NCR-registered debt counsellors will work out a personalised repayment plan, based on your affordability and legal requirements.

Step 3: You’re Placed Under Debt Review

We notify your credit providers and the credit bureaus that you’re under debt review. From this point forward, you are:

- You are protected from legal action and repossession

- You are protected from creditor harassment

- You can no longer take out new credit until all debts are settled.

Step 4: We Negotiate With Your Creditors

We will renegotiate the terms of your credit agreements to lower your instalments and extend your payment terms. This new plan allows for your essential expenses to be factored into your new repayment plan.

Step 5: Your Plan Is Made an Official Court Order

Your new restructured repayment plan is submitted to the Magistrate’s Court and, once approved, it becomes legally binding. This ensures creditors cannot change the terms or take action against you.

Step 6: You Make One Affordable Payment per Month

You pay a single amount to the Payment Distribution Agency (PDA) who pays all your creditors.

Step 7: Receive Your Clearance Certificate and Reclaim Your Financial Freedom

Once your debts are paid off, you receive a clearance certificate, and your credit profile is updated. You will be able to re-enter the credit market with a clean record.

Ready to begin your journey out of debt?

What makes Debt Counselling a Safe and Powerful choice?

You are Legally Protected from Day One

The moment you are placed under debt review, your rights are protected under the National Credit Act.

All Fees are Regulated and Built into your Repayment

Plan Debt Counselling fees are strictly regulated and included into your monthly repayment plan.

This is your new financial beginning – not a black mark

Debt counselling is a legal rehabilitative process designed to help you pay off what you owe in an affordable way.